- Home

Services Global Investing

Global Investing

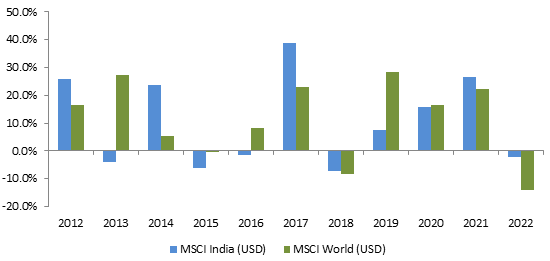

Investing in global products e.g. international stocks, ETFs, mutual funds etc, has been gaining popularity in India in recent times, especially among HNI investors. However, there is relatively less awareness about the benefits of global investing and how to invest in global products.

Sign in /

Sign in /